AI Headshot Generator Market Size: 2026 Growth & Statistics

The $400/month startup that explains where this industry is actually headed

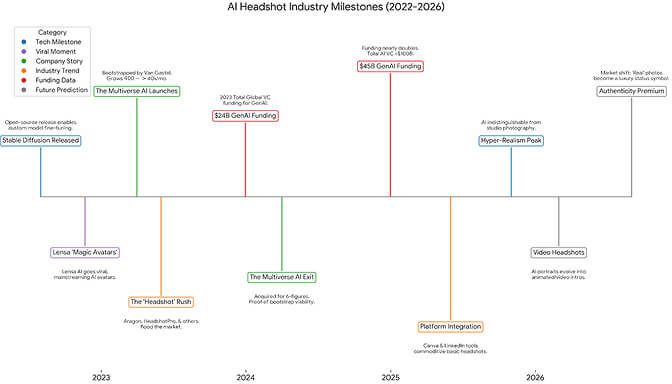

In July 2023, a Belgian entrepreneur named Tanya Van Gastel launched an AI headshot generator with exactly zero marketing budget.

Eighteen months later, she sold it.

The company, The Multiverse AI, had grown from $400 in monthly revenue to $40,000 per month. Her clients included Google, McKinsey, and Walmart. And she did it all without spending a single dollar on ads.

What the hell happened?

That's the question I kept asking myself as I dug into the numbers behind this industry. Because Van Gastel's story isn't an anomaly. It's a symptom of something much bigger.

The AI headshot generator market has quietly become one of the fastest-growing segments in the broader generative AI explosion. And the data tells a story that most people - including traditional photographers, aren't ready to hear.

The numbers nobody's talking about

Here's where things get interesting.

As of late 2024, the AI headshot and image generator market was valued at over $200 million. By 2025? Industry estimates suggest it exceeded $350 million.

By 2026, we're looking at projections north of $450 million for AI headshots specifically.

But that's just the niche. Zoom out to the broader AI image generator market, and the numbers get wild.

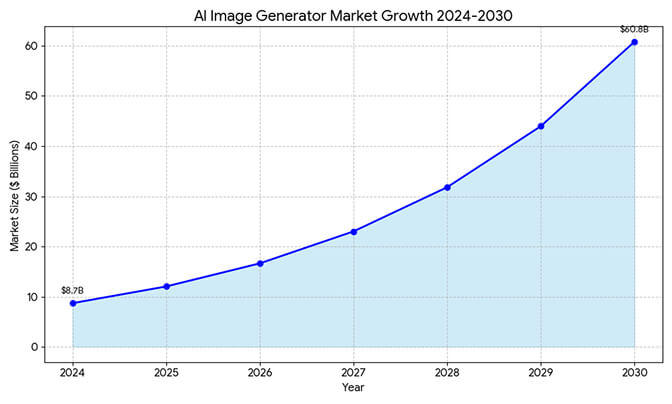

MarketsandMarkets projects the AI image generator market will explode from $8.7 billion in 2024 to $60.8 billion by 2030, a staggering 38.2% compound annual growth rate.

Let that sink in for a second.

We're not talking about incremental growth. We're talking about a market that could 7x in six years.

Why this is happening now

Three forces collided to create this moment.

First: The remote work revolution never ended.

When COVID-19 sent everyone home, it didn't just change where we work. It changed how we present ourselves. Suddenly, your LinkedIn photo wasn't just a nice-to-have. It was your first impression. Your digital handshake. Your face in every Zoom meeting.

The demand for professional headshots exploded, but the supply chain didn't keep up.

Second: The cost problem became impossible to ignore.

Here's a stat that hit me hard: A 15-minute headshot session at Yale cost one student $200. That's $800 per hour for a photographer to point a camera and click.

For a fresh graduate? That's rent money.

For a company with 500 employees who all need updated headshots? That's a six-figure problem.

AI headshots typically cost between $29 and $59. Some services generate results in 10 minutes.

The math just works.

Third: The technology crossed the "good enough" threshold.

This is the part most people miss.

AI headshots in 2022 looked... off. Uncanny valley stuff. Weird teeth. Extra fingers. Dead eyes.

But by 2024, the quality had improved so dramatically that 92% of people couldn't distinguish AI headshots from real photos according to platform claims.

Headshot Photo alone has generated over 12 million AI headshots for more than 80,000 customers. That's not a gimmick. That's a legitimate alternative.

The part nobody tells you about LinkedIn

Let me be direct: Your LinkedIn photo matters more than your resume.

That sounds like hyperbole. It's not.

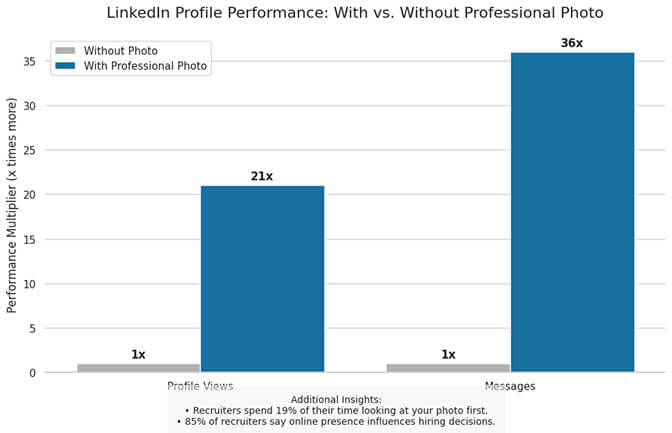

LinkedIn's own data shows profiles with professional photos receive 21x more profile views and 36x more messages than those without.

Eye-tracking research from TheLadders revealed something even more uncomfortable: Recruiters spend 19% of their time looking at your photo first. Before your experience. Before your skills. Before your fancy job title.

And here's the kicker: 85% of US recruiters and HR professionals say an employee's online presence influences their hiring decisions.

A professional headshot isn't vanity. It's infrastructure.

This is why 25% of Headshot Photo's customers specifically cite LinkedIn as their primary use case. Another 15% need headshots for company websites. 10% for resumes.

The demand is structural. It's not going away.

Who's actually using AI headshots?

The demographics surprised me.

The median age of AI headshot users? 41 years old.

Not Gen Z early adopters. Not tech bros. Middle-aged professionals who need a solution that works.

Here's the breakdown:

- Ages 28-43 (Millennials): 61% of all AI headshot customers

- Ages 44-59 (Gen X): 25%

- Ages 12-27 (Gen Z): 8%

- Ages 60-78 (Boomers): 5.5%

The Gen X adoption rate is the story here. These are senior managers, directors, VPs, people who've been putting off updating their headshot for five years because scheduling a photographer felt like too much friction.

AI removed the friction.

One HeadshotPhoto customer review captures it perfectly:

"I didn't want to deal with booking a photographer, so I tried the AI business headshot generator. The results were professional, and it was ready to use in no time"

The geographic gold rush

North America dominates. That's not surprising.

The region accounts for approximately 35% of global AI image generator revenue, driven by a culture where professional branding has become almost mandatory.

But here's where it gets interesting.

Asia-Pacific is showing the most aggressive growth trajectory. Startups and young professionals across the region are adopting AI tools faster than their Western counterparts. The combination of massive populations, mobile-first behavior, and comfort with AI is creating explosive demand.

Europe's remote work normalization has created steady, sustainable growth. When your entire team is distributed across countries, consistent professional headshots become a brand necessity, not a nice-to-have.

The market is going global. Fast.

The $100 billion question: What happens to photographers?

This is where the conversation gets uncomfortable.

Because the data doesn't tell a simple story.

On one hand, AI is clearly capturing the budget and mid-range segments of the professional headshot market. The professional headshot photography services market itself stands at approximately $1.8-2.8 billion in 2026. AI tools are eating into that from the bottom up.

On the other hand, some photography studios reported booking 15% more headshot clients in 2024 than the previous year.

Wait, what?

Here's my read: The market is bifurcating.

AI captures the convenience-driven, cost-conscious segment- the person who needs a LinkedIn photo by tomorrow and doesn't want to spend $300. Traditional photography is increasingly focused on premium, experience-driven services - the executive who wants a personal brand shoot, the company that wants consistency across 50 team members with a human creative director.

The middle market? That's where the pain is. The $150-300 headshot session that takes two weeks to schedule and delivers results indistinguishable from a $39 AI alternative.

That segment is getting squeezed.

The funding frenzy behind the scenes

The money pouring into this space tells its own story.

Global venture capital funding for generative AI reached approximately $45 billion in 2024, nearly doubling from $24 billion in 2023.

In total, VC investment in AI companies exceeded $100 billion in 2024, representing an 80% increase from the previous year. Nearly 33% of all global venture funding went to AI companies.

This isn't speculative money chasing hype. The unit economics of AI headshot businesses are genuinely attractive.

Van Gastel's The Multiverse AI grew from $400 to $40,000 monthly revenue without external funding. It eventually sold for between $100,000 and $500,000.

That's a bootstrapped business with meaningful revenue and a real exit—proof that you don't need $50 million to build something valuable in this space.

What's coming in 2026 and beyond

Let me put on my prediction hat.

The quality gap will disappear entirely.

By 2026, distinguishing AI headshots from traditional photography will be essentially impossible for anyone except forensic experts. The technology is advancing that fast.

Enterprise adoption will accelerate.

Companies like Google, McKinsey, and Walmart are already using AI headshot services. Expect Fortune 500 HR departments to standardize on AI solutions for employee onboarding, reducing both cost and time-to-hire friction.

Vertical specialization will emerge.

Healthcare. Legal. Real estate. Education. Each industry has specific headshot norms and requirements. Expect AI services to develop industry-specific offerings that understand what a "professional" headshot means in each context.

The ethics conversation will intensify.

There are real concerns here - data privacy, AI bias, authenticity questions. LinkedIn allows AI headshots but requires they "reflect your likeness." That's a gray area getting grayer.

The companies that win will be the ones that solve the trust problem - not just the technology problem.

The industries primed for AI headshot adoption

Based on the data and growth patterns, here's where I expect the biggest adoption waves:

Healthcare: Medical professionals need headshots for hospital directories, telemedicine platforms, and personal branding. The friction of scheduling a photographer during a 12-hour shift is real.

Legal Services: Law firms obsess over consistency. Getting 200 attorneys to look like they belong at the same firm? AI can solve that in a week instead of six months.

Real Estate: Agents need professional photos yesterday. And they need lots of them—for listings, for marketing materials, for social media. Volume and speed matter more than boutique quality.

Education: Online learning platforms need instructor photos at scale. The barrier to looking professional shouldn't be a $500 photo shoot.

The honest takeaway

I started researching this article expecting to find a bubble.

Instead, I found a market with genuine demand, favorable unit economics, and technology that's actually delivering value.

Is this the end of professional photography? No. But it's absolutely the end of photography as the only option for professional headshots.

The AI headshot generator market isn't just growing. It's fundamentally reshaping how professionals present themselves in a digital-first world.

For entrepreneurs, the opportunity is real - but the window is narrowing. The market is maturing fast.

For professionals, the question isn't whether to use AI headshots. It's when.

And for photographers? The ones who adapt, who move upmarket, who focus on experiences rather than outputs, who embrace AI as a tool rather than fight it as a competitor, they'll be fine.

Everyone else should be paying attention.

Because this market isn't slowing down.

It's just getting started.